Unlike traditional fiat systems run by central banks with no accountability to their citizens, Spark allows the citizens of the Flare Network to decide how much inflation will be of benefit to them. FLR holders will surely need to consider the price of FLR, f-asset collateralization ratio, value of f-assets minted, and participation rates to determine the appropriate rate of inflation until the next vote. At the end of this six-month period, FLR holders will hold a governance vote to determine the inflation rate from that point forward for the network. This means that there will be 5 billion newly minted FLR to be delivered as rewards to FLR holders participating in the FTSO over the first six months the Flare Network is live. At launch, the inflation rate will be set at 10% per year of the original supply of FLR for the first six months. In a move that will surely throw crypto community mainstays for a loop, Flare has opted to introduce an inflationary component to its network that will be governed by the holders of FLR. While there may only be 100 billion pre-minted FLR at launch, the distribution of FLR will not end there. The amount of participation from exchanges and wallets for the Spark (FLR) airdrop was unprecedented in nature and is a truly novel way of integrating existing crypto communities like Litecoin and XRP into the initial token distribution. In final, the estimated allocation of the originally minted 100 billion FLR is handed out as follows: 38 billion for eligible XRP holders, 25 billion for Flare Limited, 20 billion for Flare Foundation, 12 billion for the general f-asset rewards pool, and 5 billion for the FLTC rewards pool. However, while the unclaimed FLR was originally meant to be burned, a recent Flare blog revealed that the unclaimed FLR will be attributed to the general f-asset rewards pool, which is estimated to possibly increase to upwards of 15 billion by June 11, 2021. It is likely that the FLR delivered to XRP holders is less than 38 billion due to XRP being held on non-participating exchanges during the snapshot period and FLR unclaimed by Jon self-custody wallets. Finally, 12 billion FLR will be distributed to the rewards pool designated for f-asset minters excluding minters of FLTC because a 5 billion FLR rewards pool is specially being assigned to the minters of FLTC. Additionally, 25 billion FLR will go to the company behind the creation of the Flare blockchain, Flare Limited, and 20 billion FLR will go to the Flare Foundation, which is to be governed by FLR holders and have board members that are separate from Flare Limited.

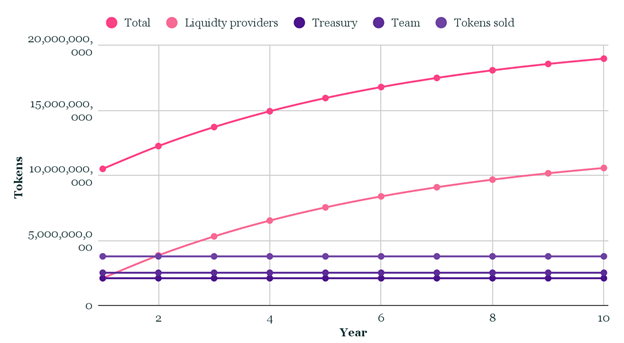

Participating exchanges and wallets can be found on Flare’s website. To have been eligible for the FLR airdrop, one would have had to hold XRP on a participating exchange or wallet on Decem– 00:00:00 UTC. Therefore, the distribution of Spark will include 38 billion of the supply being delivered to eligible XRP holders excluding known Ripple Labs wallets. The Flare Network is considered to be a utility fork of the XRP Ledger (XRPL), but unlike traditional blockchain forks, a utility fork is meant to drive value to the originating network of the fork. The starting supply of FLR will be 100 billion to be dispersed amongst various stakeholders over the course of 25 – 34 months with an average of 3% of the total supply per month being released to pre-allocated parties. Now that we have established what Spark (FLR) is, we can dive into the distribution and future release schedule of FLR, which like the network has been developing.

FLR is not used for the security of the network allowing for the functionality and scalability of the digital asset. As an incentive for FLR holders to provide accurate data estimates to the oracle, the FTSO delivers daily rewards to FLR token holders whose data feeds are within the inner 50% of all data estimates provided for each closure of the FTSO, which happens every few seconds.

#Flr token price series

FLR acts as a governance and collateralization mechanism for the Flare blockchain as it can be posted as collateral for the minting of f-assets and simultaneously be used to provide data estimates to the Flare Time Series Oracle (FTSO). Originally, Flare had planned for the native asset of its network to be a stablecoin however, those plans have been scrapped in favor of Spark (FLR). Since Flare Network was first announced back in November 2019, the Flare blockchain has been adapting to meet the demand for its smart contract capabilities. *** Updates to FLR distribution reflect 1/19/21 for this article.

0 kommentar(er)

0 kommentar(er)